Current Ratio Benchmark by Industry

Cash ratio is a refinement of quick ratio and indicates the extent to which readily available funds can pay off. The current ratio is a widely used metric in financial analysis.

Ratios And Measurements In Farm Finance Umn Extension

Current ratio indicates whether the bank has enough cash and cash-equivalents to meet its short-term liabilities for a specific time frame usually one.

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Ratio_Jul_2020-02-8806530bcda84b2b9cb3218413e8a417.jpg)

. For most industrial companies 15. Acceptable current ratios vary from industry to industry. Gross profit margin Gross profit Revenue.

This metric indicates a companys ability to meet short-term. The bankers will look at these industry benchmarks as they assess your stores performance. ROE Return on equity after tax - breakdown by industry.

22 rows All Industries. It compares current assets with the current liability to assess if the business has sufficient liquid funds. Current Ratio Current Assets.

Financial performance of a specific company based on financial ratios is very often assessed related to some benchmark. In the given case the industry benchmark is 2. Commonly acceptable current ratio is 2.

Gross profit margin gross margin is the ratio of gross profit gross sales less cost of sales to sales revenue. Or manually enter accounting data for industry benchmarking Manufacturing. If current assets of the.

75 rows The current ratio indicates a companys ability to meet short-term debt obligations. As you can see from the table above we provide profitability ratios liquidity ratios such as current ratio or quick ratio gearing ratios or solvency ratio activity ratios and various. What the Ratios Tell.

Net income after tax. The mostly known benchmark measure for any financial. The current ratio is an essential financial matric that helps to understand the liquidity structure of the business.

Return on equity ROE is the amount of net income returned as a percentage of shareholders equity. The current ratio also known as working capital ratio is a financial performance measure of company liquidity. Average industry financial ratios for US.

Its a comfortable financial position for most enterprises. Quick Ratio - breakdown by industry. 22 rows All Industries.

Average industry financial ratios for US. The data used to calculate the activity statement ratios for the 201516 financial years was sourced from business and instalment activity statements processed up to 31 October 2016. Its especially helpful for the businesses lenders that assessability of the.

The quick ratio is a measure of a companys ability to meet its short-term obligations using its most liquid assets near cash or quick assets. Current Assets Current Liabilities. More about current ratio.

D - Manufacturing Measure of center. Current ratio indicates the liquidity of a company and whether it is able to repay its short term obligations in a timely mannerA higher current ratio above 2 is generally deemed.

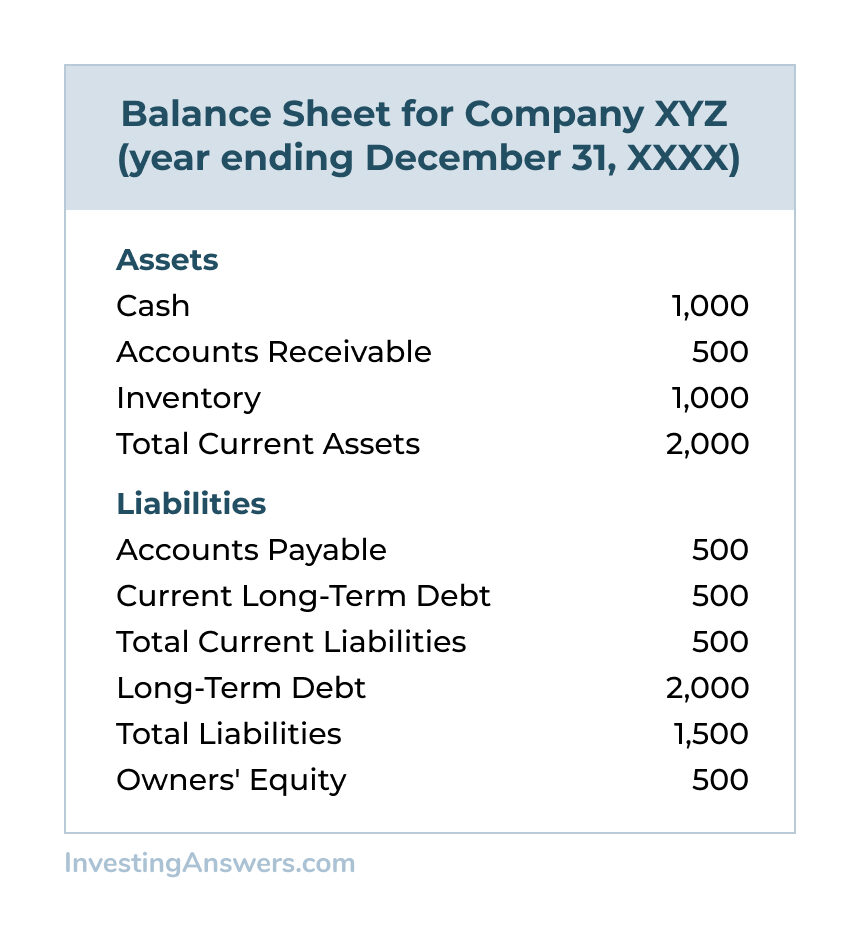

Current Ratio Example Definition Investinganswers

What Is A Good Eps Financial Analysis Financial Management Accounting And Finance

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Ratio_Jul_2020-01-2261aa1f53a947508e23a4b93b350cdb.jpg)

Current Ratio Explained With Formula And Examples

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Ratio_Jul_2020-03-54eeb2ed66a546ad8c2f1e5e86366170.jpg)

Current Ratio Explained With Formula And Examples

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Ratio_Jul_2020-02-8806530bcda84b2b9cb3218413e8a417.jpg)

Current Ratio Explained With Formula And Examples

Using Ratio Analysis To Manage Not For Profit Organizations The Cpa Journal

0 Response to "Current Ratio Benchmark by Industry"

Post a Comment